Some Known Incorrect Statements About The Best Scalping Technique

Table of ContentsTop Guidelines Of The Best Scalping TechniqueHow The Best Scalping Technique can Save You Time, Stress, and Money.The Best Guide To The Best Scalping TechniqueThe Best Strategy To Use For The Best Scalping TechniqueThe smart Trick of The Best Scalping Technique That Nobody is Discussing

The Stocks & Exchange Payment (SEC) calls for that pattern day traders keep a minimal balance of $25,000 in their trading accounts whatsoever times. That rule limits accessibility to this method for investors with smaller investment portfolios. You've been energetic in the market for some time as well as you're prepared to try your hand at scalping.Yes, scalping is lawful. SEC policies call for high-frequency investors such as scalpers to keep a minimum of $25,000 in your trading account at all times.

Its high volatility normally makes it an appealing asset to attempt to scalp. Beware of the potentially high trading fees that can eat into your crypto profits. Heading is simply one kind of trading that suits some participants better than others. A few other day trading methods you might desire to think about include:.

These investors search for the most significant moves throughout any provided trading session as well as take activity to manipulate them commercial. Pullback traders look for supplies that have a strong as well as consistent fad upwards. The investor sees the graph closely, searching for a pullback. When downward activity happens, the trader acquires the supply, wishing to have purchased it at a discount as well as have the ability to make use of the healing.

The Best Scalping Technique Things To Know Before You Buy

When the stock breaks over resistance, it's likely to make a solid action upward, developing chances for day investors. These stocks are likely to make large motions in the market, developing possibilities for investors - The Best Scalping Technique.

Scalping is an amazing technique that numerous effective investors have utilized to come to be millionaires. It's not for every person. Only those with a good understanding of the marketplace and the threats related to trading, combined with strong technical analysis skills, should consider scalping.

The forex market can be unpredictable and as opposed to revealing small cost changes, it can periodically collapse or change instructions totally. This calls for the scalper to assume with prompt impact on just how to make sure that the setting does not sustain too several losses, as well as that the subsequent professions offset any losses with better revenues.

Some Known Questions About The Best Scalping Technique.

Consult our money and also risk management overview for more recommendations (The Best Scalping Technique).

Even if you are a full newbie in trading, you will certainly have more than likely encountered the term "scalping" eventually. In this short article, you will certainly find out the response to 'what is scalping in Forex', exactly how it functions and also exactly how to select your own Foreign exchange scalping trading system. Additionally, we will additionally have a look at Foreign exchange scalping strategies, concentrating in particular on the prominent 1 min scalping approach.

When it pertains to Foreign exchange, a scalping trading system needs making a big number of professions that each target small revenues. As opposed to holding a position for numerous hours, days or weeks, the objective of scalping Forex is to earn a profit in minutes, or perhaps secs, just a few pips at once.

In order for those 10 pip gains to include up to a considerable revenue, scalping is usually performed with high quantities. To get more information concerning the pros and also disadvantages of Forex heading for beginners, along with the very best as well as worst times to scalp, enjoy our totally free webinar video clip: Intrigued in discovering more about trading? At Admirals, we host regular trading webinars covering a variety of trading topics.

The smart Trick of The Best Scalping Technique That Nobody is Talking About

In addition, check my reference there are only a couple of hrs a day when you can scalp currency pairs. After time availability, the next most crucial point is having the ability to think on your feet. For a Foreign exchange scalping strategy to be rewarding, you should promptly anticipate where the market will certainly go, and afterwards open and also close positions within an issue of seconds.

Whilst your primary job is to produce much more lucrative positions than shedding ones, you need to also recognize exactly how to leave professions when they are not working out. You need to keep in mind that Forex scalping is not a trading design that is visit this site right here appropriate for everybody.

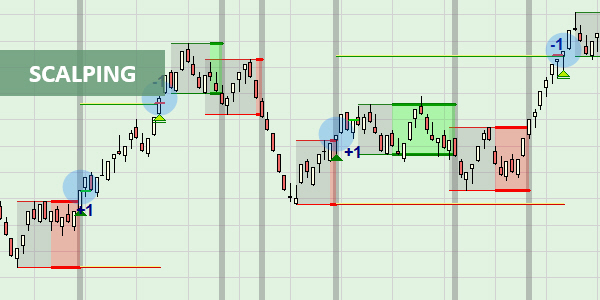

Both 1-minute as well as 5-minute durations are the most usual. Your acceptable profit or loss per profession will certainly depend on the moment structure that you are using. With 1 min scalping, you would probably be looking for an earnings of around 5 pips per profession, whereas a 5-minute scalp could probably provide you with a reasonable target of 10 pips per profession.

That being said, volatility should not be the only point you are looking at when selecting a money pair. You ought to also look for a pair that is economical to trade, simply put, the one that will certainly give you with the least expensive feasible spread. For an effective scalper, the spread will take visit this site right here in between 10% to 30% of their earnings.

Things about The Best Scalping Technique

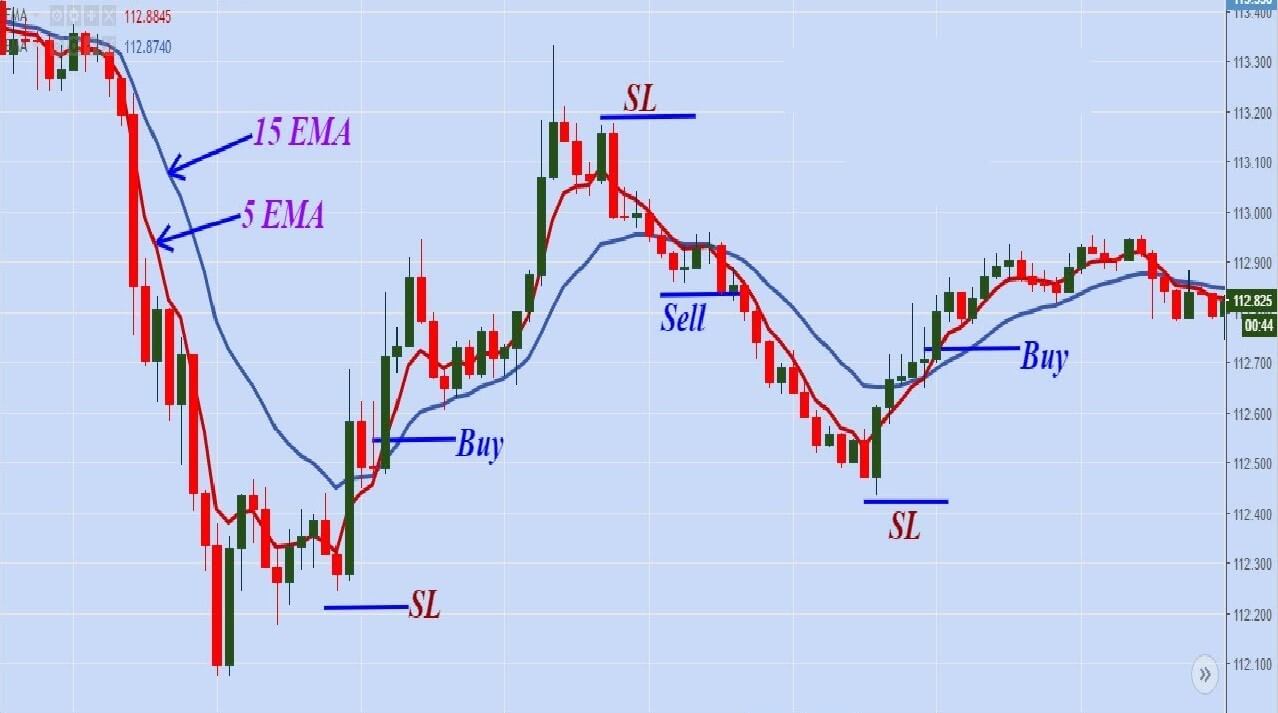

You will certainly require to establish a Foreign exchange scalping trading system based upon Foreign exchange heading indications. After this, as soon as you see an entry signal, you need to go for the trade, and if you see a departure signal, or you have actually involved an acceptable degree of revenue, you can shut your profession.

Whilst it is usually constantly recommended to utilize an SL and also TP when trading, scalping may be an exception to this guideline. The reason is basic - you can not lose time executing your professions because every second matters. You may, obviously, set SL as well as TP degrees after you have actually opened a trade, yet lots of investors will scalp manually, implying they will shut professions when they struck the optimum appropriate loss or the desired profit, instead than establishing automated SL or TP levels.

When trading 1 whole lot of EUR/USD, the worth of a pip is USD 10. This means your direct cost would be regarding USD 20 by the time you opened up a placement.